Value is the core notion that allow efficiency’s assessment. As we detailed various methods of efficiency appraisal, we used a common monetary approach, without digging further on this notion for later. We’re now later! The monetary approach to evaluate inputs and outputs is, as the verb indicates, rely on the notion of value.

Now what is value?

Taken from Collins dictionary:

“The value of something such as a quality, attitude, or method is its importance or usefulness. If you place a particular value on something, that is the importance or usefulness you think it has.”

Two notions are important to understand value:

- Value varies with logical and predictable factors. It is correlated with the usefulness (or importance) of the subject to evaluate. An easy example: umbrellas worth more when it rains, and ice cream when there’s an heat wave. So despite value not being fixed, its fluctuations can be modeled based on a series of rational factors.

- Value varies with illogical factors too. As from the definition, assessors value subjects usefulness on what they think they have. Easy example two: from afar, I think that the umbrella is broken, therefore that umbrella worth nothing. I have not inspected it, so it is irrational, but these are assessments we do all the time. So value fluctuations depend on factors that are nearly impossible to model.

Therefore, value is anything but accurate and stable.

How to assess efficiency if we can’t value inputs/outputs?

Very easily, just by carrying with us hypothesis inherent to value. So efficiency will vary with time and between person, but it can be estimated. By standardizing the approach using monetary terms, the economic world effectively imposed a model deemed rational. Any value estimation use a set of data and variables, ground through a formula more or less complex. This provides an hypothetical ‘price’, which is then put to the test of market demand (or not). Now if we focus on financial efficiency alone, this value will then be assess again periodically, using similar method, to see whether the subject gained or lose in value.

Again, the reassessed value is not necessarily going through the test of market. If the formula is inaccurate, and if the value is never going through impairment tests, that type of practice can eventually lead to serious problems… Once the priced item is finally off to the market, two consequences: either someone else valued your item at the same price (or higher), in which case you can sell and monetize; either no one does, and you can just cry.

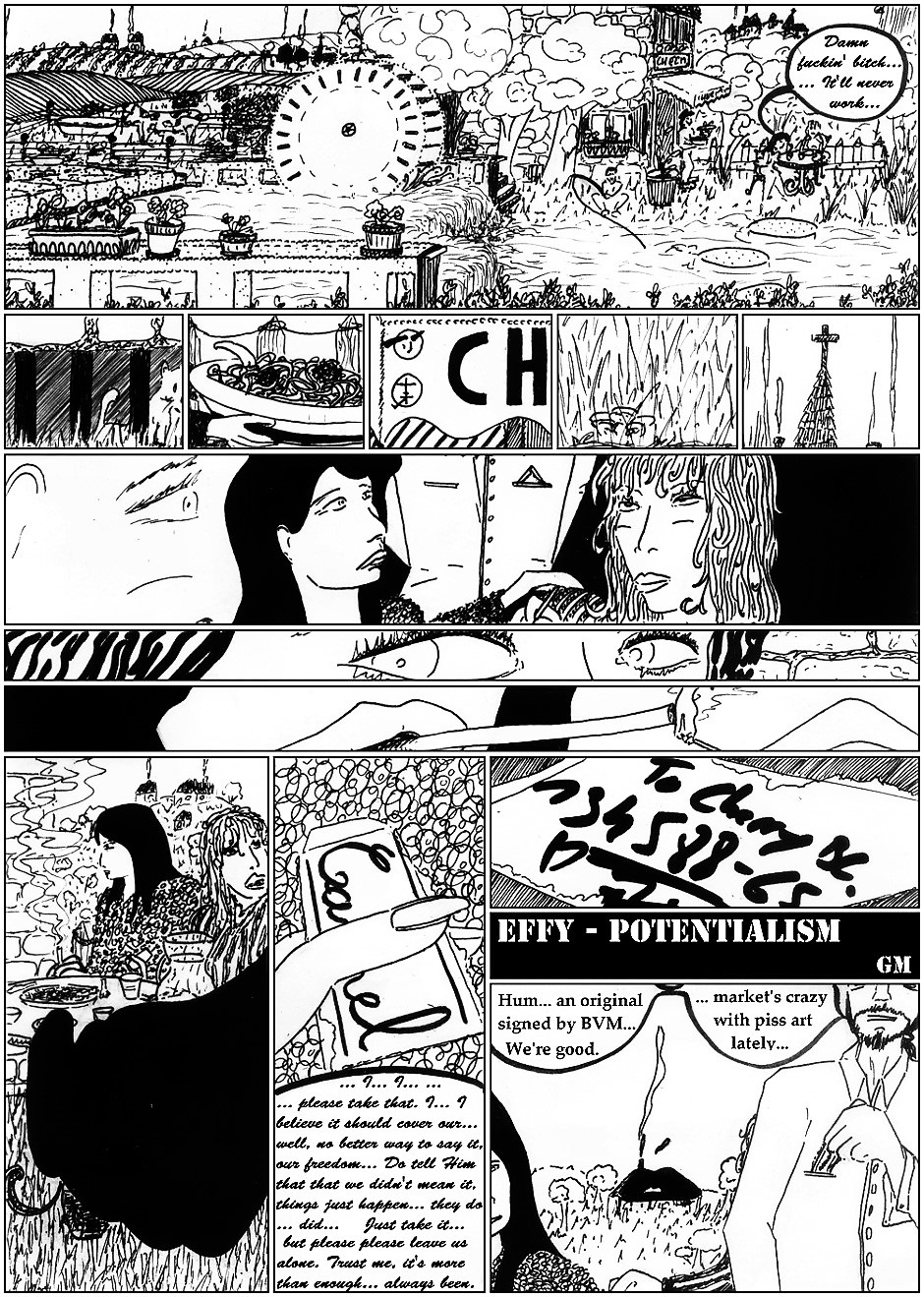

How does this episode of Effy have anything to do with any of that?

Glad you asked. The art market, more than any other, heavily relies on illogical factors that are hard to predict. This makes art value very volatile and risky. In other terms, people value these items very differently, using a wide range of factors in their formula. Example using Les Femmes D’Alger de Picasso:

a. Cost based estimation: canvas + paint + brushes + time… not much.

b. My daughter’s estimation based on how pretty: she laughed… so probably near 0.

c. Sold price 197.4 millions USD.

All values are correct, and all incorrect too. Considering the rise of market value of Banksy and Koons, it is safe to say that modern art is currently trendy, for how long, that remains a question. And so, our couple of girls paid off their debt using a autographed scrap of cigarettes, while Effy hovers above the uncertainty of all this.

G.M.

[…] 29 – Potentialism […]

[…] input can be simplified into a unit of cash. Debate about valuation aside (refer to Potentialism), inputs are always more than just a unit of currency. This is even more so when we deal with human […]

[…] Potentialism […]