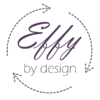

Batch thirteen, and almost a year of Effy – The living efficiency. Time for G.M. to start some yearly review and be consumed in finance routine; and we’re now with episodes about sweat flow statement or written in accounting… wait what? Yep, he did that!

Don’t miss G.M.’s weekly updates on Effy’s own page or through Tapas!

Financials. such as P&L and cash flow statements, are a cyclic tradition (from weekly to yearly), where data are piled up, crunched, sorted, analyzed, and then distorted for comments. They are finance’s mean to evaluate a subject efficiency over a period, in monetary terms. As I was reviewing Effy By Design‘s latest cash flow while observing Effy H’s dedication behind her sewing machine, an idea jumped at me… but first,

What is cash flow statement?

Definition (from Investopedia):

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and […] all cash outflows that pay for business activities […] during a given period. [G.M. note: I have excluded the investment portion to keep simple.]

So in essence, a cash flow statement list all cash inflows and outflows over a period, and gives a net position. It tells you: have I increase or decrease my cash balance?

Cash isn’t necessarily the most relevant data to assess a company’s financial efficiency (profit being number one), it is however a vital indications. Cash is to company what blood is to the body. You might not be very efficient having it, but you would certainly die without…

And so I trailed that thought, shaping parallels between cyclic cash flows & other flows.

Extending the logic to periodical flow statements!

And I started to methodically build up innovative statements, such as:

- Weekly happy time statement: Easy to do, and quite objective based on estimated time records. I was in deficit last week, but the balance remains positive. But considering a lifetime, I really wonder where my balance would be!

- Daily love flow statement: Purely subjective, but to rationally analyze the irrational is always fun. I found it however quite dangerous, when I started analyzing data to optimize, so I dropped it.

- Daily water flow statement: Very instructive, and I now do a rough assessment everyday, to ensure my water intake is healthy.

- … and so on… you name it…

So it just gives another tool to assess a subject efficiency over a period.

Weekly sweat flow statement?

And for this episode of Effy, I tried to apply this logic to a young Chinese factory seamstress we once met with Effy H (that girl also was the inspiration behind “cost efficient yawns“). Seven panels for seven days. Six days of tiring hours to craft fast fashion, that almost entirely vanished in one happy Sunday hour. Realistically not sustainable for her life balance, but she sees it in a different way, and who are we to judge…

Wait wait wait, Christmas treat!

Last but not least, an early Christmas treat. You can download and print the mini-comics for this episode and Flowers’ Republic on my page at “8 pages comics” website. Hope you enjoy!

Persuasion! Similar yet quite different from argumentation… So here’s an abstract animated illustration to highlight Effy’s multiple tools and techniques that she loves employing to persuade!

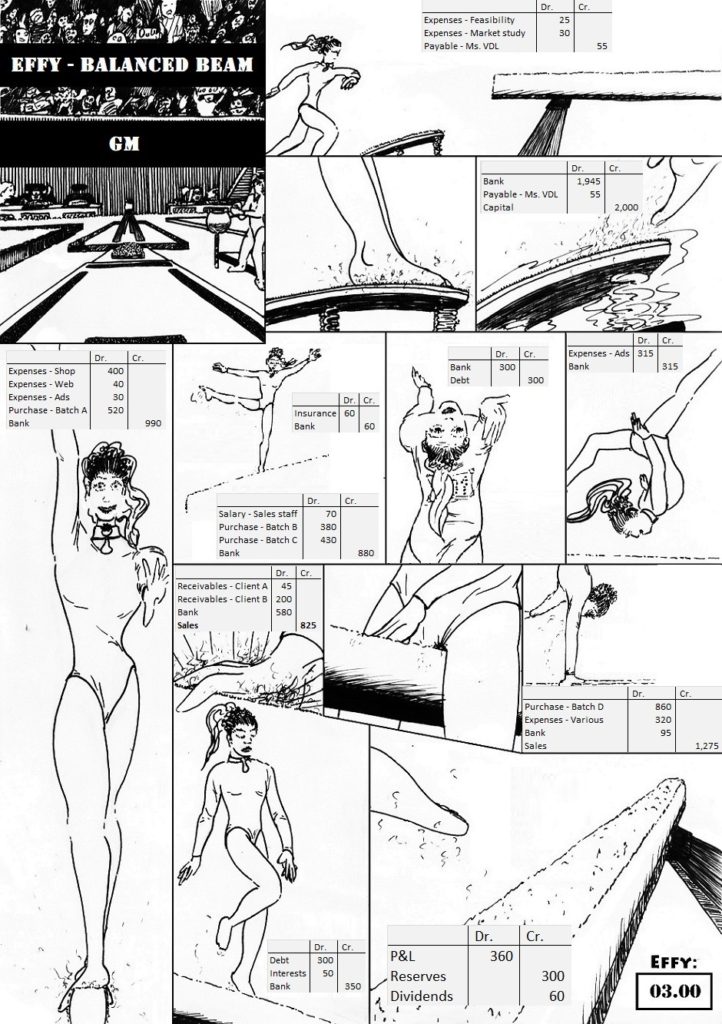

Financial efficiency has a language on its own, and that is accounting! And as any other language, accounting creates a body of literature to narrate stories of efficiency. And as any other language, it’s hard to find good writer (accountant), editor or critics (controllers & auditors).

Accounting literature

Accounting is a system of conventionalized methods, processes and symbols used to translate every flows into monetary terms. This allows all inputs and outputs to be comparable, giving a baseline to assess efficiency. We discussed in previous episodes some of the drawbacks of using a single unit (monetary in this case) to assess efficiency, but there’s no better and widespread alternative so far…

So, accounting narrates efficiency, for good or bad. Companies’ accounting books contain stories of efficiency, stories to entertain, scare, humor… There’s drama, romance and even tragedy (irrational monsters ready to slay employees’ life generally sleep in intangible and provision accounts).

As any other language, accounts can have under-text, metaphors, ellipsis, implied meaning, and almost all the possible literary methods available to writers. So reading financials and accounting books requires more than just technical knowledge on accounting. To simplify, someone speaking basic english might not necessary understand all nuances of classic poetry, and accounting works the same.

Not all accountants are refined artists, and not all controllers are wise critics. Therefore, companies must be very careful on how they select accountants and controllers.

Accountants, controllers and auditors

Accountants are reliable writers. They must know their craft, and use it to build an accurate, coherent, and reliable narrative. Sincere, yet smooth. A balance must be found, between data accuracy, and the way to package it. Accountants are easy to find. They even have diploma to help. However, good accountants are like good writers, so the literary skills generally improve with practice and the support of editors.

Controllers are editors and critics. They must be able to recognize and strip down the core story from the stylistic elements that accountants use to embellish. They must be able to see through accountants’ literary tricks and genres’ trope, to get a clear picture of the reality of the organization’s efficiency. Unfortunately, unlike accountants, good controllers are harder to find, harder to train, and harder to retain.

Harder to find because there’s no diploma. Talent and ability really comes from the person’s critical abilities, common sense and professional experiences. Besides, as much as for literary critics, each genre… hum… industry… can use very different narratives. So a good manufacturing controller might not be very good for the consulting industry.

Harder to train, because on top of technical knowledge (the accounting language, and analytical tools), controllers must have a specific personality that is hard to teach: curious, inquisitive, and critic…

Harder to retain, because good controllers are generally not properly valued. Controllers’ ability to analyse, understand and point out efficiency’s issues are vital to correct and improve. However, other collaborators generally undertake corrective actions, so organizations end up underestimating controllers’ role.

And auditors? they’re pretty much useless but necessary… like influencers that value their fame selling favorable reviews on Amazon…

As for Effy?

I used accounting to tell a small yarn of dedication, perseverance and hope, to close off 2020 on positive notes. And even though 3% isn’t that great, it’s a decent base to enter 2021.

More accounting and value related episodes:

The concept of efficiency assumes that processes can improve with time. From generations to generations, we learn from experience and best practices, we modify and adjust processes to achieve the best result while using the lowest resources.

As a result, by looking back on the evolution of any given trade, we can get a basic view on:

- What people perceived as efficient in that particular trade,

- What are the tactics that previous generations have used to achieve such efficiency.

Very often, and for most trade, financial efficiency wins over bare efficiency. And therefore, financial efficiency is often gained at the expense of human or environmental considerations. It was as such, with tactics such as the obvious slavery and forced labor. It is as such, you can refer to the list below for examples. And it will remain as such because social and environmental regulations will always have loopholes…

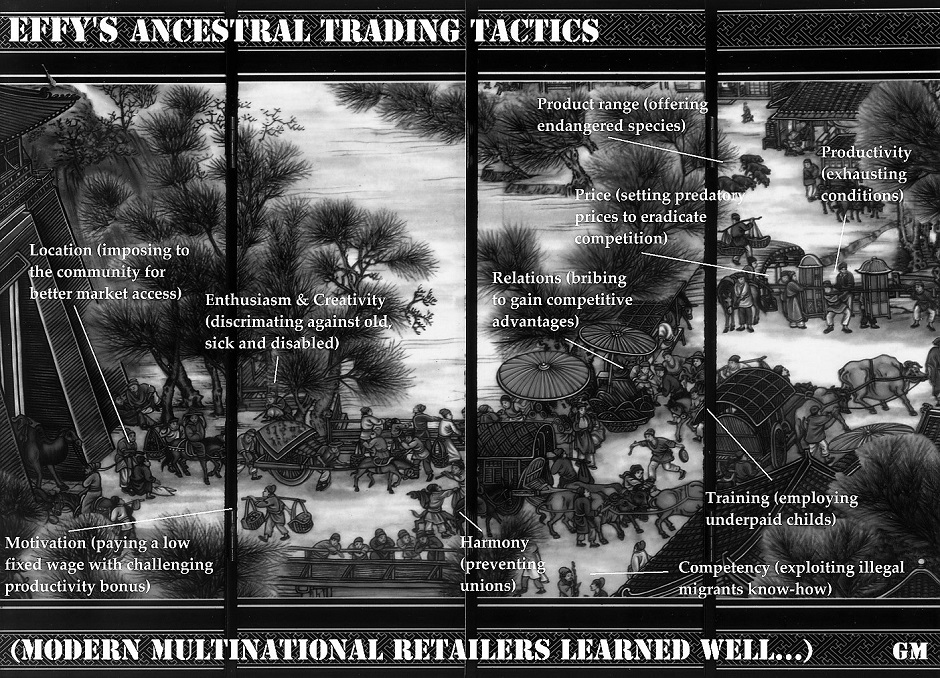

So this episode of Effy is slightly special, using a fac-simile of an old chinese scroll to highlight some of classics commerce’s trading tactics. Don’t get me wrong, this is not a chinese matter, and we can observe similar processes all around the world. For curious people, below are examples of companies employing some of the tactics that the episode has described (but again, you could do the exercise for any other trade or profession):

- Walmart: https://en.wikipedia.org/wiki/Criticism_of_Walmart

- Amazon: https://en.wikipedia.org/wiki/Criticism_of_Amazon

Both are north american, but you can find similar practices in Carrefour (french), Alibaba (chinese), and so on.