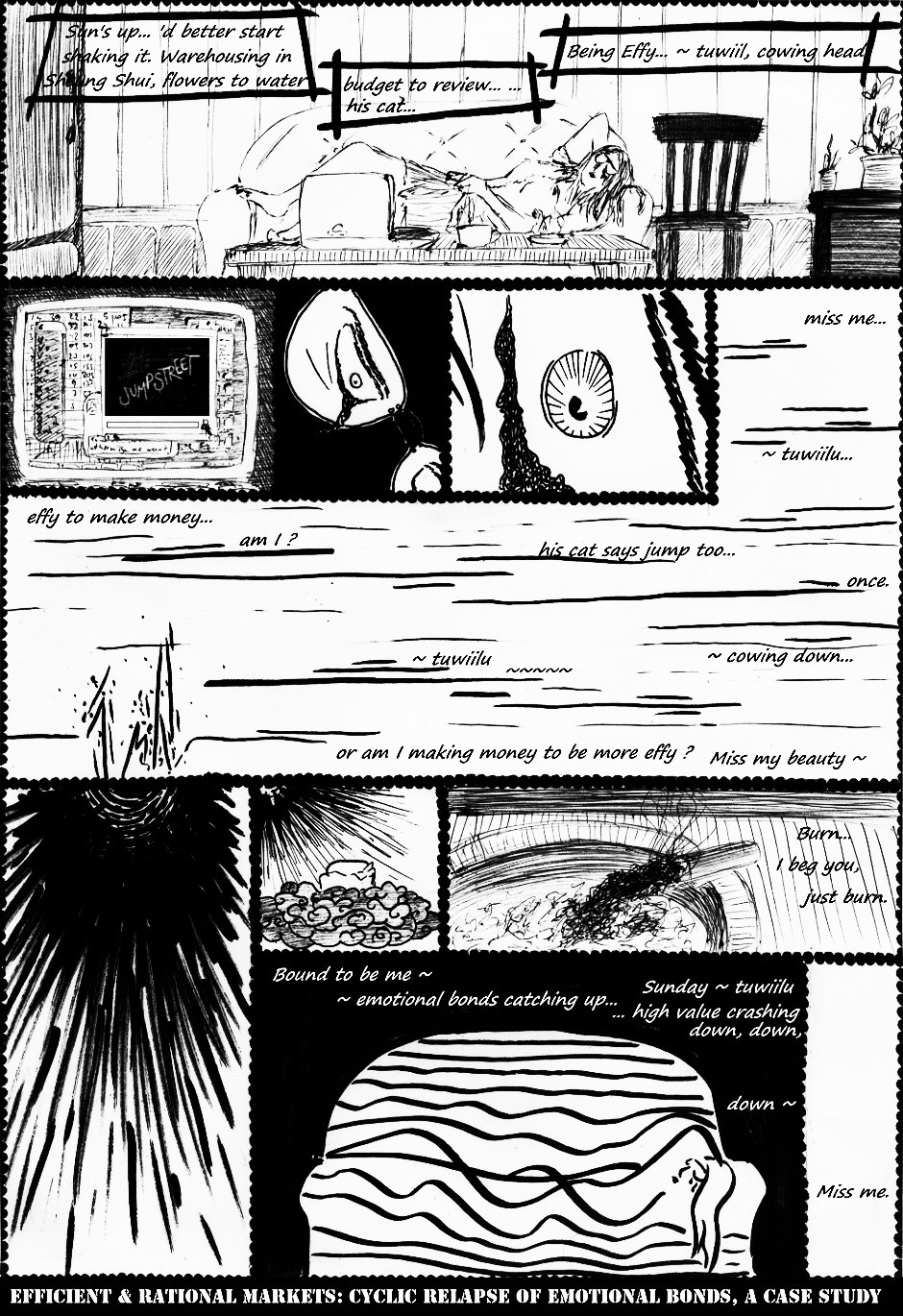

For outsiders, chaotic fluctuations seem to govern financial markets, which become like a moody roller coaster. Using rational markets theory, let’s analyze how much alike these actually are, and derive insights into efficient and rational mood.

Rational markets, EMH and anomalies

The Efficient Market Hypothesis (EMH) roughly states that markets are rational, in a sense that prices always reflect the sum of all available information. The theory is an old subject of finance literature (you can refer to Investopia article for details, or Research Gate study for more in-depths on market rationality). What the theory implies is that markets cannot be beaten. Values are always accurate, so you can’t buy items at a price lower than rational price, nor sell items at inflated price. Values fluctuations result from the flow of available information.

In real life however, values are subject to many factors limiting EMH. I’ve developed some in previous articles ‘Potentialism’, and together with incomplete information or transaction costs, these factors create prices anomalies that can be exploited by buyers or sellers.

Anomalies mean that yes, markets can be beaten, adding abnormal fluctuations and creating the seemingly chaotic world of financial markets…

Now all this was not today’s topic. Here is today’s topic:

Rational mood, EMH and anomalies

Another seemingly chaotic and very fluctuating field is mood. So following the same logic, let’s play with definitions and see how the theory stand if we switch arguments. “Markets, a place where buyers and sellers exchange goods for value”; becomes: “Mood, a place where senses exchange feelings for emotions”.

The Efficient Mood Hypothesis (EMH) roughly states that mood is rational, in a sense that emotions always reflect the sum of all available information. What the theory implies is that mood cannot be beaten. Emotions are always accurate, so you can’t sense feelings with an emotion lower than the rational emotion, nor sense feelings with an inflated emotion. Emotions fluctuations result from the flow of available information.

In real life however, emotions are subject to many factors limiting EMH. I’ve developed some in previous articles ‘Potentialism’, and together with incomplete information or sensual exhaustion, these factors create emotional anomalies that can be exploited by senses.

Anomalies mean that yes, mood can be beaten, adding abnormal fluctuations and creating the seemingly chaotic world of emotional mood…

Effy in all that?

In this episode, Effy puts the hypothesis to the test. However anomalies were too strong and prices (sorry emotions…) irrationally crashed.

G.M.

[…] 40 – Cyclic relapse of emotional bonds […]