Financial efficiency has a language on its own, and that is accounting! And as any other language, accounting creates a body of literature to narrate stories of efficiency. And as any other language, it’s hard to find good writer (accountant), editor or critics (controllers & auditors).

Accounting literature

Accounting is a system of conventionalized methods, processes and symbols used to translate every flows into monetary terms. This allows all inputs and outputs to be comparable, giving a baseline to assess efficiency. We discussed in previous episodes some of the drawbacks of using a single unit (monetary in this case) to assess efficiency, but there’s no better and widespread alternative so far…

So, accounting narrates efficiency, for good or bad. Companies’ accounting books contain stories of efficiency, stories to entertain, scare, humor… There’s drama, romance and even tragedy (irrational monsters ready to slay employees’ life generally sleep in intangible and provision accounts).

As any other language, accounts can have under-text, metaphors, ellipsis, implied meaning, and almost all the possible literary methods available to writers. So reading financials and accounting books requires more than just technical knowledge on accounting. To simplify, someone speaking basic english might not necessary understand all nuances of classic poetry, and accounting works the same.

Not all accountants are refined artists, and not all controllers are wise critics. Therefore, companies must be very careful on how they select accountants and controllers.

Accountants, controllers and auditors

Accountants are reliable writers. They must know their craft, and use it to build an accurate, coherent, and reliable narrative. Sincere, yet smooth. A balance must be found, between data accuracy, and the way to package it. Accountants are easy to find. They even have diploma to help. However, good accountants are like good writers, so the literary skills generally improve with practice and the support of editors.

Controllers are editors and critics. They must be able to recognize and strip down the core story from the stylistic elements that accountants use to embellish. They must be able to see through accountants’ literary tricks and genres’ trope, to get a clear picture of the reality of the organization’s efficiency. Unfortunately, unlike accountants, good controllers are harder to find, harder to train, and harder to retain.

Harder to find because there’s no diploma. Talent and ability really comes from the person’s critical abilities, common sense and professional experiences. Besides, as much as for literary critics, each genre… hum… industry… can use very different narratives. So a good manufacturing controller might not be very good for the consulting industry.

Harder to train, because on top of technical knowledge (the accounting language, and analytical tools), controllers must have a specific personality that is hard to teach: curious, inquisitive, and critic…

Harder to retain, because good controllers are generally not properly valued. Controllers’ ability to analyse, understand and point out efficiency’s issues are vital to correct and improve. However, other collaborators generally undertake corrective actions, so organizations end up underestimating controllers’ role.

And auditors? they’re pretty much useless but necessary… like influencers that value their fame selling favorable reviews on Amazon…

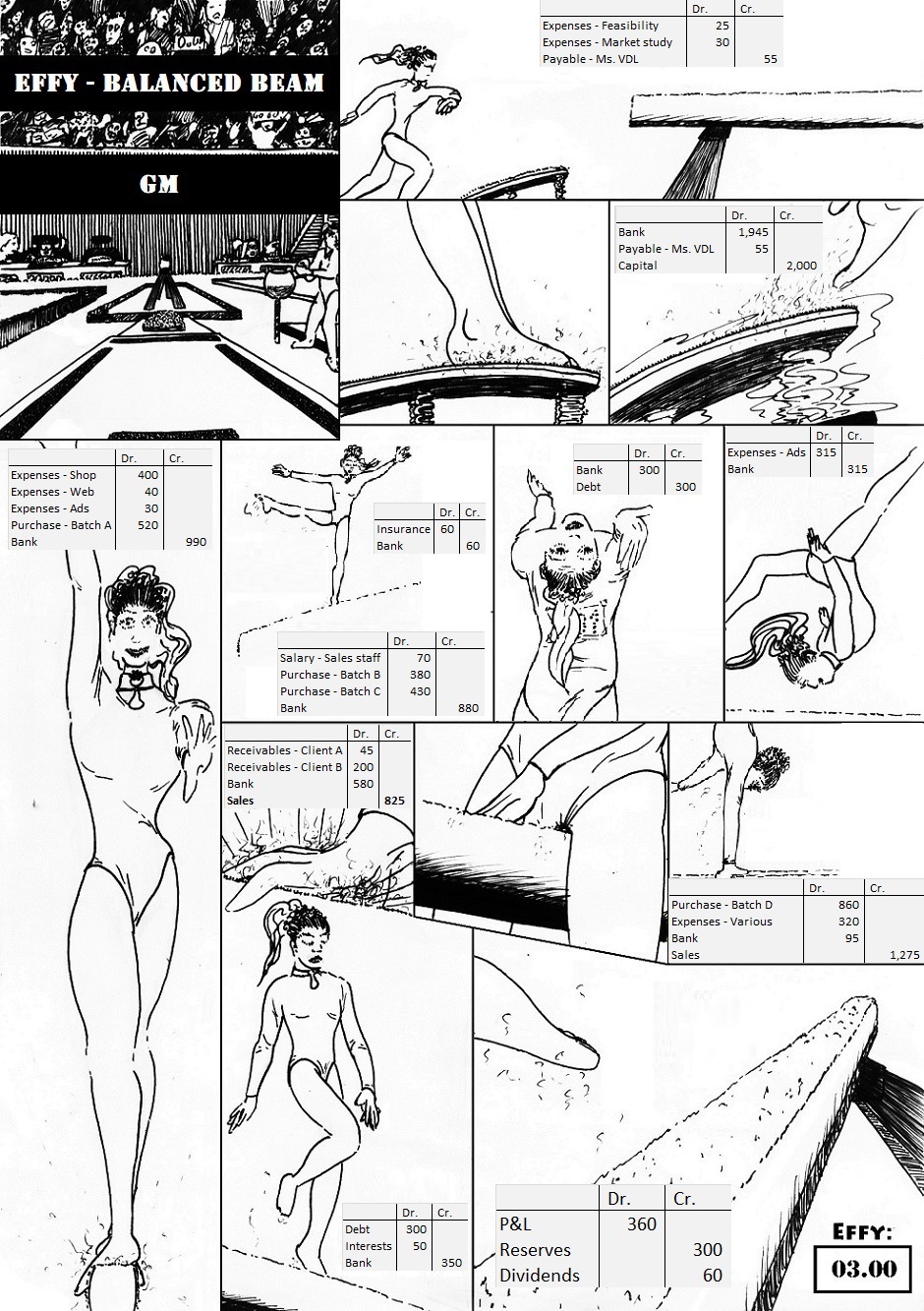

As for Effy?

I used accounting to tell a small yarn of dedication, perseverance and hope, to close off 2020 on positive notes. And even though 3% isn’t that great, it’s a decent base to enter 2021.

More accounting and value related episodes:

[…] 51 – Balanced Beam […]