Batch ten of Effy – The living efficiency is contemplative… less abrasive, a step back to look around… Maybe we ought to worry for G.M..

Don’t miss his weekly updates on Effy’s own page or through Tapas!

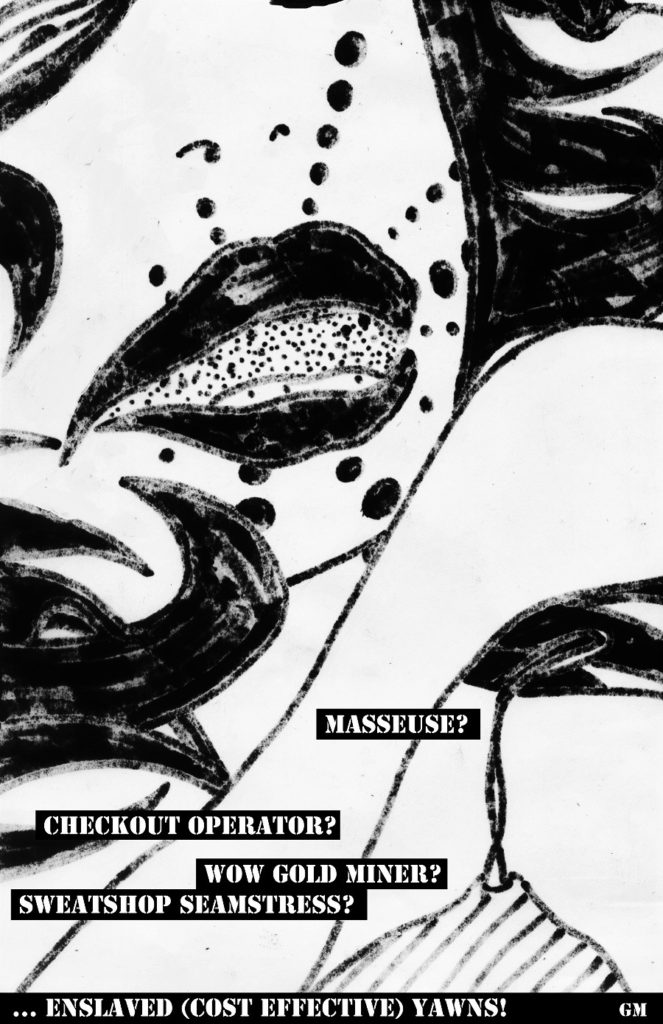

Cost efficiency is a simple and popular mean to assess a process efficiency. However, its over simplification limits analytical usage, and its internal logic promotes guilt free exploitation. Let’s take a deeper look.

Definition of cost efficiency

Cost efficiency is a type of economic efficiency. Unlike output based efficiency (you can refer to Clit Eastwood Achieves), cost efficiency is an input based concept, which focus on inputs (resources) measured in cash. A cost efficient process is a process that either:

- optimizes outputs for a given amount of cost (increase kwH per 1 dollar of costs), or

- minimizes the cost of input for a stable output (reduce dollar per 1 kwH in energy).

It is slightly different than cost effectiveness, and you can refer to Daily Writing Tips for the semantic debate.

Cost efficiency is an important tool to assess the efficiency of a subject, because it narrows down the complexity of efficiency into two variables: inputs (in currency unit) & outputs (in a given unit). This simplification makes it very easy to communicate to larger population (employees, markets, citizens and so on). As a result, cost efficiency is very popular as a tool of communication, more than a tool of analysis.

It is a weapon of negotiation, that negotiators use to argue on price evolution (other negotiation techniques can be found in Tioli episode). The indicator that politician use to defend or attack policies. The Trojan Horse that management communicates, to back-up investments (often expensive ones), or drastic cost strategies (generally costs reduction ones).

Limits of the concept

Facing such popularity, cost accounting has evolved to provide such indicative simplification on demand. That being said, from a cost audit perspective, backing database and allocation hypothesis are generally far more informative. They can light up the process structure and inefficiencies more than the resulting indicator itself could. So cost efficiency isn’t without analytical merit, at least because it requires a rather accurate cost calculation, which is meaningful.

However, drawbacks of such popularity is that the logic becomes a dogma (more about that in Firing Effy). As such, it diffuses and promotes misconceptions that are distorting non finance people.

- Every output can be simplified into a unit of output. This overlooks harmful outputs of a process, that indicators generally exclude or minimize. This is sometimes on purpose, sometimes not (refer to Humanitis).

- Every input can be simplified into a unit of cash. Debate about valuation aside (refer to Potentialism), inputs are always more than just a unit of currency. This is even more so when we deal with human resource (refer to scrap vs. waste).

The second point is the rationale behind guilt free exploitation.

Exploitation as ultimate objective

As defined in The Free Dictionary, exploitation is “the act of employing to the greatest possible advantage”. In economic terms, it is the exact culmination of an optimized cost efficiency as we define above. Ideally, zero costs, abundant outputs… In term of human resource, most cost efficient solutions the world have witnessed were slavery or forced labor of prisoners. Not so far behind are jobs with a very low pay and redundant tasks, in which exhausted yawns amount next to nothing in terms of cash. Robots are slowly replacing human resources for these jobs. This improves cost efficiency, but alternative jobs are now becoming a challenge.

All this is not new, but it is always important to keep it in mind when acting based on cost efficiency index alone for process heavy on human resource, and ponder your decision with moral to find a balance. Oh, and by the way, price / hour is a cost efficiency indicator.

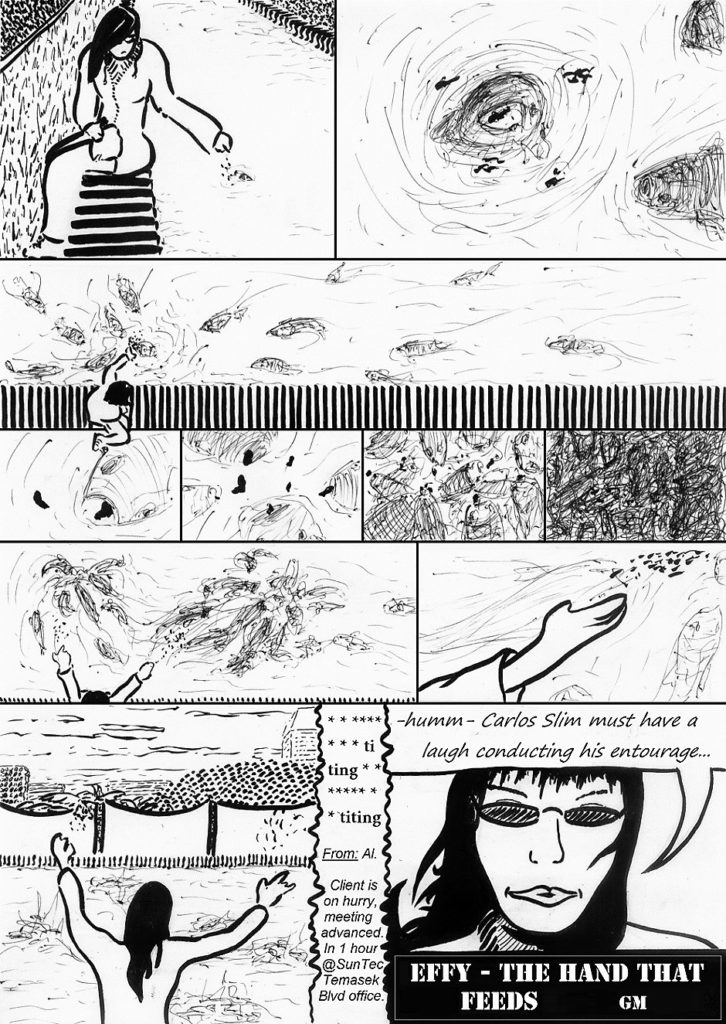

Management efficiency is often credited to leadership, without analyzing the role of authority, or perceived authority. In this episode, Effy uses wealth to analyze and demonstrate the role of perceived authority.

Difference between leadership and authority

Efficient management is not about leadership, it is about authority. Using the definition from Merriam-Webster, authority is the “power to influence or command thought, opinion, or behavior”. This slightly differs from leadership which focus on… leading. The action. The practical execution. Leadership exists without authority, it is not a necessary factor. However, I argue that having authority leads to a more efficient management. Leaders lead the way, having authority injects purpose & meaning, which fuel motivation (Effy’s take on motivation). So authority increase coherence between resources (inputs), and simplify interests to perform the process (and generate outputs).

Simple example: if I were to order you to send me your basic identification details, you probably wouldn’t. Even if I give you pen, paper, and all resources you need to perform the task, and even if I send mine to you first . However, if your boss / a policeman / tax website / a family member / your bank asked you to do so, you probably would. That’s the role of authority, it gives purpose to an order. And the greater the authority, the faster and more accurate your answer will be.

So authority increases efficiency, even more for processes heavily relying on human resources.

Sources of authority

Authority and authority figures are an important subject in psychology. The famous experimentation from Milgram highlighted the central role of authority to indirectly motivate people to perform tasks they would normally refuse to do (if you never heard of these, please do yourself a treat and check them out, summary from Simply Psychology).

Authority can be given, but not necessarily. It is more often derived from other attributes, such as location, behavior, costume, elocution, charisma, external appeal, and so on. It depends on the subject, and the purpose. So using all these attributes to increasing perceived marker of authority directly improve management efficiency. In other words, if you want your team to improve in speed and accuracy, or your sale network to explore new markets, or your band to kick ass in hip hop: talk and dress the part!

As always with conceptual efficiency, there’s no moral line. It means that what can be used by a priest to obtain more donations and fed the poor, can also be used by con artists… mechanisms of authority in efficiency are the same.

Wealth as an attribute of authority

Among all possible sources of authority, wealth has always been an important attribute. It directly link with primal needs. This is also a factor behind the widening wealth gap within companies, because higher management would argue that their authority (and management efficiency) increases with their perceived wealth. I must admit that this matches observations from my professional experiences; employees are more likely to follow people with higher perceived wealth.

It becomes a vicious circle, with wealth gap widening -> perceived authority of wealth increasing -> bigger spread in revenues allocation -> wealth gap widening…

So today, Effy played with Koi carps… with her perceived wealth (seeds), to ensure an efficient dance in the pond, while her own boss plays with her agenda…

Further reading:

Obedience, power & leadership (Principle of Social Psychology)

Our habitual responses to authority (Psychology Today)

Widening wealth gap (Inequalities)

Leadership and decision making (Effy – The living Efficiency)

Note: Carlos Slim has been in world richest men top 25 for decades, you can read the full list in real time on Forbes’ website.

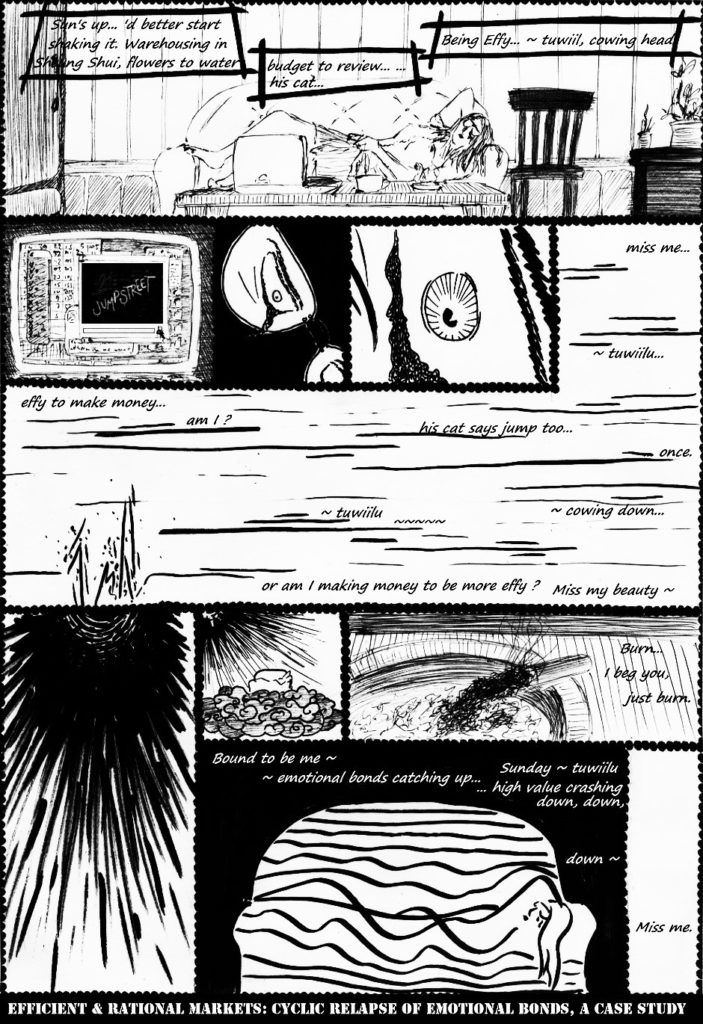

A small bonus page on emotional efficiency unleashed (a type of straight efficiency).

For outsiders, chaotic fluctuations seem to govern financial markets, which become like a moody roller coaster. Using rational markets theory, let’s analyze how much alike these actually are, and derive insights into efficient and rational mood.

Rational markets, EMH and anomalies

The Efficient Market Hypothesis (EMH) roughly states that markets are rational, in a sense that prices always reflect the sum of all available information. The theory is an old subject of finance literature (you can refer to Investopia article for details, or Research Gate study for more in-depths on market rationality). What the theory implies is that markets cannot be beaten. Values are always accurate, so you can’t buy items at a price lower than rational price, nor sell items at inflated price. Values fluctuations result from the flow of available information.

In real life however, values are subject to many factors limiting EMH. I’ve developed some in previous articles ‘Potentialism’, and together with incomplete information or transaction costs, these factors create prices anomalies that can be exploited by buyers or sellers.

Anomalies mean that yes, markets can be beaten, adding abnormal fluctuations and creating the seemingly chaotic world of financial markets…

Now all this was not today’s topic. Here is today’s topic:

Rational mood, EMH and anomalies

Another seemingly chaotic and very fluctuating field is mood. So following the same logic, let’s play with definitions and see how the theory stand if we switch arguments. “Markets, a place where buyers and sellers exchange goods for value”; becomes: “Mood, a place where senses exchange feelings for emotions”.

The Efficient Mood Hypothesis (EMH) roughly states that mood is rational, in a sense that emotions always reflect the sum of all available information. What the theory implies is that mood cannot be beaten. Emotions are always accurate, so you can’t sense feelings with an emotion lower than the rational emotion, nor sense feelings with an inflated emotion. Emotions fluctuations result from the flow of available information.

In real life however, emotions are subject to many factors limiting EMH. I’ve developed some in previous articles ‘Potentialism’, and together with incomplete information or sensual exhaustion, these factors create emotional anomalies that can be exploited by senses.

Anomalies mean that yes, mood can be beaten, adding abnormal fluctuations and creating the seemingly chaotic world of emotional mood…

Effy in all that?

In this episode, Effy puts the hypothesis to the test. However anomalies were too strong and prices (sorry emotions…) irrationally crashed.