G.M. started batch six of Effy – The Living Efficiency very annoyed… anger became chaos, that lead to deep introspection, and finally elevation to ultimately frame the whole economic world!

Don’t miss his weekly updates on Effy’s own page or through Tapas!

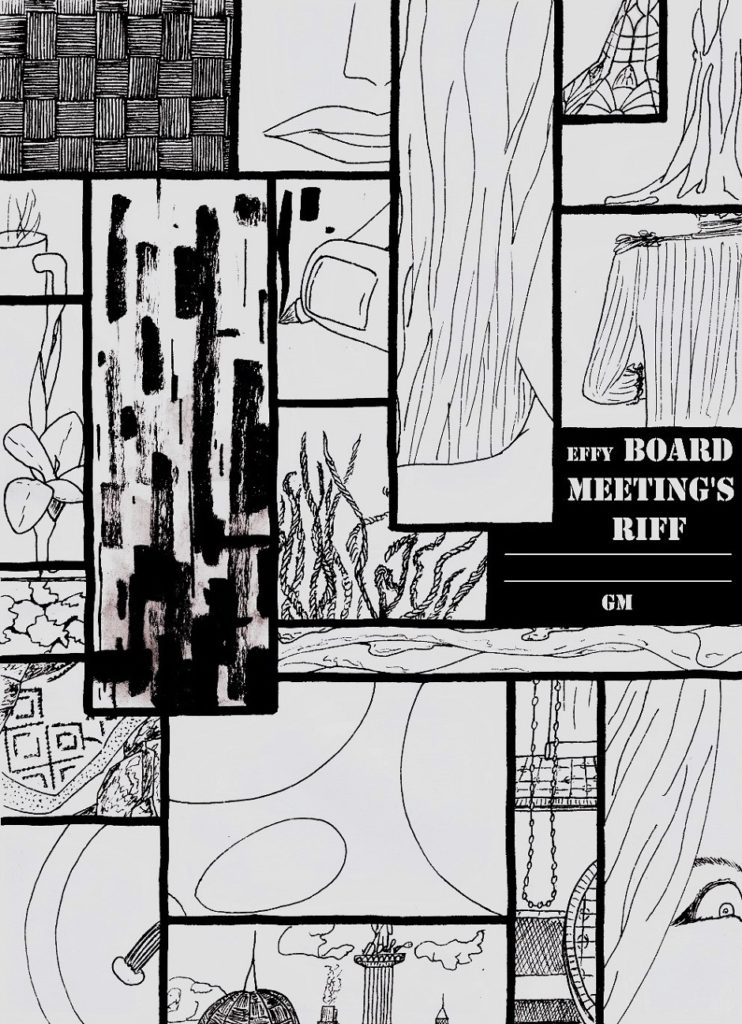

The unbearable lightness of board meeting nonchalance

Ah… the quietly decisive board meeting nonchalance. Today, I attended a preliminary meeting to plan mid-year financial landing for a 1000+ employees company. An informal board of director meeting just followed, to confirm orientations. For those not familiar, the board of directors is the governing body of an organization that decides main strategies and validates policies (definition from Business Dictionary here).

The average remuneration of members around the table was 400kUSD / year (6 members), a remuneration level that increased around 4.6% yoy. In comparison, the company wide salary increase has been 4%, de facto mitigated by pyramid refreshment policies (read -> replace mid-high salaries by newcomers), making the average remuneration increase budgeted around 0.4%.

Despite HY1 gross margin dramatically below previous years (excluding impact of Covid); or the large impact from Covid under activity further deteriorating operating results; or massive de-commit on budget and forecast levels on both profitability and cash; despite all of that, words were spoken politely, jokes were shared occasionally, and figures were discussed superficially. Classic board meeting nonchalance because, well:

- Covid has been the right excuse to dump all poor decisions and bad news. With all mistakes buried under: “impact of Covid”. So much that, the closing decision was to show result worse than the reality. All this in order to overplay Covid’s negative impact over poor management and to keep some buffer to cover future mistakes.

- A massive 1MUSD restructuring plan was approved by the European headquarter, effectively leaving 100+ staff unemployed while safekeeping directors’ bonus (which are based on result before restructuring).

- Summer holidays are right around the corner, so there’s no time to engage in real action now, that will have to wait September.

So this strip is just that, wandering thoughts that decorated the mild tone and light nonchalance of that bored meeting. A polite and pleasant meeting, to wisely hide incompetence and leave 100 people home without a job.

Chaos Theory and Efficiency

Chaos theory and efficiency are closely related, as chaos feeds efficiency. We defined efficiency previously Continuing Education and Humanitis (comments section), but the main take away is that efficiency generates more than the sum of resources it uses.

The more resources at disposal; the more possibilities and alternatives. A quick example, take a box of lego, your creations will be limited by the number, shape, color of pieces available in the box. To increase possibilities for your creations, you will need to buy new boxes. The more lego you have, the more solid, aesthetic or fun your creation will become, because you will have optimized solutions to shape your objective. The same goes with efficiency. Efficiency in a limited and standard world lacks the volume, malleability and potential of resource to generate optimal outputs. In other words, efficiency needs to feed from resources diversity to gain shape.

Chaotic systems provide the most diversity. Chaos theoricians define chaos “not about disorder but rather about very complicated systems of order” (ThoughCo website). From an efficiency point of view, this definition underlines the potential: by understanding, isolating, and using the right resource or sequence or ordered resource, greater efficiency can be achieved. Take market price variation as example. Financial markets are sometime perceived as a chaotic, with a multitude of factor and variables impacting price variations. However, by understanding and isolating main driving factors, while using statistical information to order and model price behavior, financial efficiency can be achieved. The more data you’ll get, the more potential you will have to shape your predictions and reach efficiency (here is an article about chaos theory and investment from Investopedia).

In this episode, Effy (the living efficiency) gains shape from the chaotic environment of the city. Ultimately, she reaches a physiological balance once surrounded by chaotic noises and flows.

Debunking lack of resource in efficiency issues

A decade ago, I worked as financial controller in a glass bottle manufacture located in the south of China. Actually, the “Guele de bois” chapter of Stand(H)ard is heavily influenced by that experience. For years, the plant suffered continuous losses, which were explained by a so-called ‘lack of efficiency‘. My task was to improve the situation, or else, support management in closing the company.

To summarize, a glass manufacture is a never ending furnace. You feed sand, broken recycled glass and energy; and the furnace spits out a river of burning melted glass. Blades and moulds cut then shape glass into all kinds of bottles. Bottles continue to cool down passing through smaller ovens before inspection, sorting, packaging and finally shipment. S0 basically: Equipment + Sand + Oil + People = Glass bottles.

“Lack of resource”

As discussed in the Reflecting Vixen, ‘efficiency’ was the go to answer to solve and explain everything. In my first round of reviews with managers, the lack of efficiency results from another department’s mistake or lack of equipment. When investigating solutions, very few reviewed their own process or method.

My team and I of course crunched numbers and provided countless of analytical studies. We provided piles of focused and specific studies to measure the financial impacts of variations for every little details. All this to help support better decision making that could ultimately help the company reverse the trend and revert to profits. As much as I’d love to say that my work provided answers, it didn’t. Don’t get me wrong, if anyone is asking me about it, I will still vouch for financial analysis and data based decision to be the source of improvement, I mean that is after all why clients are paying me. But the reality is that improvements and ultimately efficiency came from somewhere else.

“Simple actions and innovative solutions”

Every week, new data and analysis were an excuse to meet with every managers one by one. Rather than arguing about figures, we just walked through their workshop, reviewed flows (in and out), and brainstormed potential process improvements. We listed action plans, from ‘immediately doable’ to ‘need heavy investment’. It was obviously unthinkable to do any additional investment at this point and considering accumulated losses, but a direct rebuff would have been poorly perceived. And so heavy investments items were left on the back burner, but still high in managers’ dreams. Meanwhile, we start implementing all simple and immediately doable items. The reality is that workers and managers know how to improve and be more efficient, but hardly anyone sincerely ask them. Figures are relevant to identify and rank problems, but less to provide concrete and reliable solutions.

Most actions were every basic, such as installing white boards between departments to feedback quality and adjust settings such as temperature. Some required more imagination, such as installing slides to feed raw materials into batching feeders After three months, things were already turning back up, with an improved efficiency without any new major investments nor restructuring plan. After a year, we recorded the first profitable year in a decade.

So what?

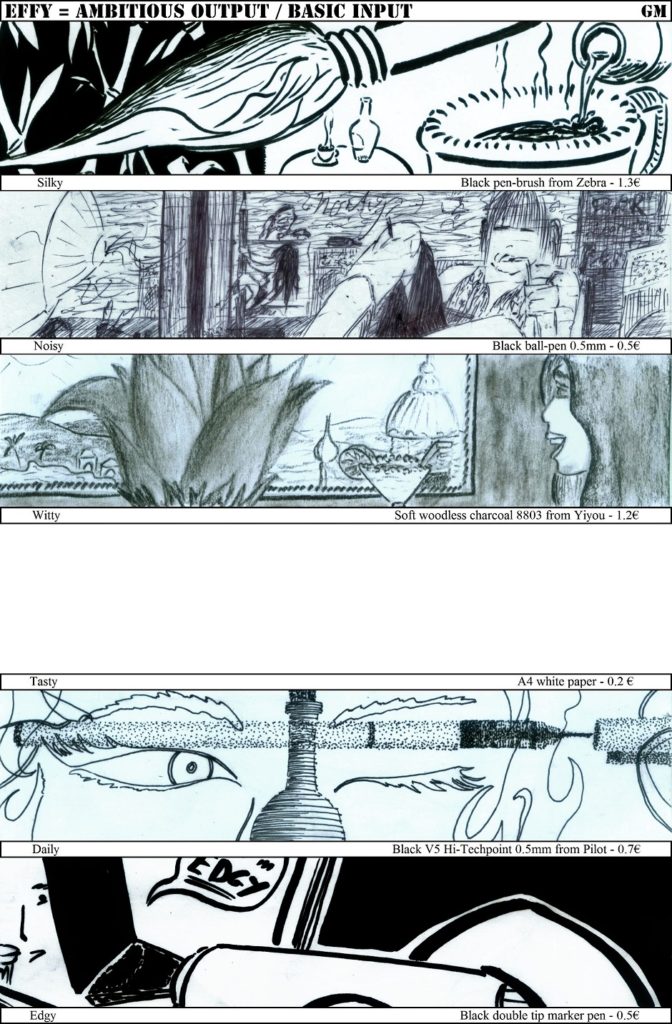

So the moral is that efficiency doesn’t need much resource. Efficiency needs ambition, basic tools, will and dedication, and so does “Effy – The Living Efficiency“.

Resources and Economy

In this episode, Effy framed world’s economy and its main resources as we know (albeit some might be missing). Energy, cash. human, all integrated within the big mechanism of economy. So what happen when economy collapse? Let’s rely on pop culture…

The weakest link was a British game TV show that run for several years. It consisted of teaming individuals that progressed through questions, earning money with every good answer. Every few rounds, the host invite candidates to name the weakest link. Contestants were expelled from the group one by one, until there was only one left. The game was so popular that it spawned versions all around the world.

It is the epitome of companies’ modern perspective on human resource, spread to the working class (let’s be blunt here). No other TV program better embodied the modern logic of talent management: detecting, exploiting, isolating, thinning… The show, along with all the similar real TV shows based on “compete to eliminate”, instilled a culture that favors individuality as the source of success. This is obviously inaccurate, and only serves to feed the top of the pyramid.

Going back to efficiency definition and waste, every resource has specificity, to base on, generate new solutions, and generate valuable by-products. Detect talent and potential, nurture, develop, until eventually, the talent outgrown the resource and merge process.