Batch eight of Effy – The living efficiency oozes of G.M.’s influence. A patchwork of Ashley Wood, Prodigy, King Gesar and Banksi to explore value, innovation, economic mission and leadership.

Don’t miss his weekly updates on Effy’s own page or through Tapas!

Value, Volatility and Financial efficiency

Value is the core notion that allow efficiency’s assessment. As we detailed various methods of efficiency appraisal, we used a common monetary approach, without digging further on this notion for later. We’re now later! The monetary approach to evaluate inputs and outputs is, as the verb indicates, rely on the notion of value.

Now what is value?

Taken from Collins dictionary:

“The value of something such as a quality, attitude, or method is its importance or usefulness. If you place a particular value on something, that is the importance or usefulness you think it has.”

Two notions are important to understand value:

- Value varies with logical and predictable factors. It is correlated with the usefulness (or importance) of the subject to evaluate. An easy example: umbrellas worth more when it rains, and ice cream when there’s an heat wave. So despite value not being fixed, its fluctuations can be modeled based on a series of rational factors.

- Value varies with illogical factors too. As from the definition, assessors value subjects usefulness on what they think they have. Easy example two: from afar, I think that the umbrella is broken, therefore that umbrella worth nothing. I have not inspected it, so it is irrational, but these are assessments we do all the time. So value fluctuations depend on factors that are nearly impossible to model.

Therefore, value is anything but accurate and stable.

How to assess efficiency if we can’t value inputs/outputs?

Very easily, just by carrying with us hypothesis inherent to value. So efficiency will vary with time and between person, but it can be estimated. By standardizing the approach using monetary terms, the economic world effectively imposed a model deemed rational. Any value estimation use a set of data and variables, ground through a formula more or less complex. This provides an hypothetical ‘price’, which is then put to the test of market demand (or not). Now if we focus on financial efficiency alone, this value will then be assess again periodically, using similar method, to see whether the subject gained or lose in value.

Again, the reassessed value is not necessarily going through the test of market. If the formula is inaccurate, and if the value is never going through impairment tests, that type of practice can eventually lead to serious problems… Once the priced item is finally off to the market, two consequences: either someone else valued your item at the same price (or higher), in which case you can sell and monetize; either no one does, and you can just cry.

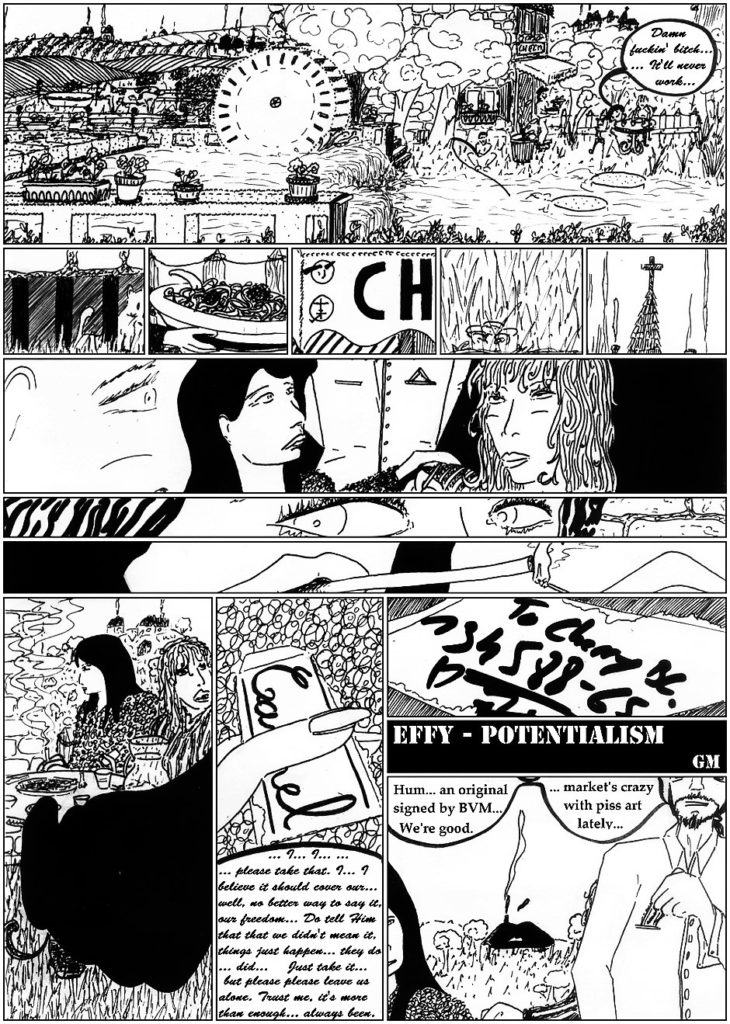

How does this episode of Effy have anything to do with any of that?

Glad you asked. The art market, more than any other, heavily relies on illogical factors that are hard to predict. This makes art value very volatile and risky. In other terms, people value these items very differently, using a wide range of factors in their formula. Example using Les Femmes D’Alger de Picasso:

a. Cost based estimation: canvas + paint + brushes + time… not much.

b. My daughter’s estimation based on how pretty: she laughed… so probably near 0.

c. Sold price 197.4 millions USD.

All values are correct, and all incorrect too. Considering the rise of market value of Banksy and Koons, it is safe to say that modern art is currently trendy, for how long, that remains a question. And so, our couple of girls paid off their debt using a autographed scrap of cigarettes, while Effy hovers above the uncertainty of all this.

Innovation

This week, Effy investigates innovation. As we covered before, innovative solutions can be a source of efficiency, providing new alternatives. The more alternatives you have, the more likely it is to find an optimal solution that will lead to improved efficiency.

Sources of innovation

Overall sources

Compared to centuries back, the world of intelligence is now developing at a faster pace. It’s all but logical to have ideas sprouts and bloom since we now have have:

- A sharp increase of booming talents (world population drastic increase as seen in bio-synergy part one & part two),

- A wider source of universal and accessible knowledge (gigantic databases to identify trend from),

- Powerful tools (acceleration of technological progress).

Within an entity

Innovations are still hard to unearth, that’s what make them innovative. As a result, organizations often sets an incubation pole, in order to nurture and develop innovations. It might be limited to a lab center or R&D department, but some organization use the full spectrum of their structure to develop a culture of innovations. 3M has for long time been the text book example of that (Harvard Business Review example here), a company in which innovations is valued and promoted vertically at all level, and horizontally for all matters. Other organizations develop an innovating environment providing the fertile ground for innovations (a good article about innovation drivers from New and Improved). The purpose of such structure is to develop an innovating environment that will help creative approach.

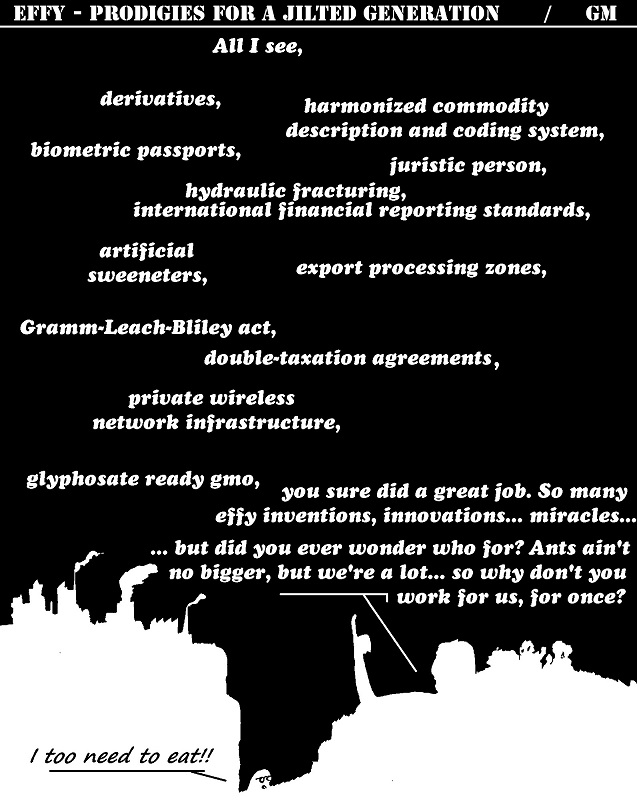

Valuable innovations?

A quick browse on internet about top ten innovations of all time (National Geographic one here for example, and the Famous Inventors one here), and wheel, electricity, vaccine, printing press or internet will pop-out. That’s an optimistic rewriting of history. Innovations are not always meant for the universal good. It’s actually the opposite most often that not. A quick look at the patent registry will tell you that innovations are generally aiming at benefiting a limited group. The invention of a patent registry was in itself for the benefit of a limited group (inventors). This is not a moral judgement, just a factual statement. To break it down even further, some are genuine improvements for that particular group that do not impact other groups. However, most often, these innovations are against other groups.

The Block-Chain example

Let’s take “block chain” to further illustrate my point (a quick history article from 101BlockChains and another one from Forbes). The original innovation secure transaction in an innovative way. It was an open resource, perfected by an anonymous person. At that point, the innovation was just a tool, free for the benefit of most. Various entities are now using that block of innovation to develop their own services. Among the earliest and most famous, BitCoin, which was mainly aiming at benefiting the limited group of tech savvy people that wish to stay away from banks and transaction supervision. Now, entities such as banks and states that tryied their best to ban access to this technology, use it to develop their own offer (crypto-currency, contract management applications, comics exchange platforms and so on); with the objective to reduce processing costs and replace cash. Working for a company developing such solutions, this is the real sales pitch: Reduce costs, replace cash. This objective is mostly detrimental to users and staff, but most innovations based on block-chain are of this nature.

I mean… remember when internet was anarchy?

So in the end, innovations are landmark universal gains for all, carrying countless tiny ones that are detrimental for most and benefiting a few. Which one overweight the other? It’s hard to say and matter very little in the end, because it’s what we call progress, and you can’t really fight the future.

But why is it that inventive prodigies agree to that?

Effy said it loud and clear, because innovators need to eat. That’s why they invented patent registry too. As sad as it is, there’s nothing to gain in universal benefit, mostly troubles. So innovations often work hand in hand with financial efficiency.

A case study on mission statement

Effy is here to help people achieve their goal, and in business it’s called a mission statement. Yet, efficiency feels less and less relevant, without guiding vision or mission.

Business 101 – Mission statement

Economy and business courses generally start with an overview of vision, mission, values and strategies. To summarize, the idea is that before you start doing anything else, you should consider what is it that you want to achieve and offer. That are you here for, what is your mission. All the rest will derive from this. Your offerings, organization’s structure, internal values and policies, all should be tied in a coherent way to help you achieve your mission. Besides, how sincere and how well you convey your mission will also impact your collaborators’ motivation, stakeholder’s involvement and attractive to the market. This is the guiding light, and your success can be assessed on how close you are in achieving it.

That is business 101 theory…

Mission and financial success: coherent?

Business reality also says that you need profits to survive and that financial profits equal success. So now let’s play a game of coherence and see how these two matches. Here are Global 500 top 10 companies per profits for 2019 (source Fortune 500):

- Saudi Aramco – 111 MUSD

- Apple – 60 MUSD

- ICBC (Industrial & Commercial Bank of China) – 45 MUSD

- Samsung – 40 MUSD

- CCB (Construction Bank of China) – 38 MUSD

- JP Morgan – 32 MUSD

- Alphabet – 31 MUSD

- ABC (Agricultural Bank of China) – 31 MUSD

- BOA (Bank Of America) – 28 MUSD

- BOC (Bank Of China) – 28 MUSD

So these are companies with the greatest gap in volume between the sum of their revenues and the sum of their costs for the 2019 period (simple definition). They are a sample of what we could call financially successful companies.

Let’s now examine the top 5 vision & mission statements for fun.

Saudi Aramco:

- Saudi Aramco is a company owned by Saudis, that deals in energy (including oil). Their mission is clear, they work for their shareholders, and target to be a monopoly. They are successful. Their website also lists some corporate, social and environmental responsibilities they claim to adhere to, but I will let you balance how important these are against the company core mission when it comes to make business decisions.

Industrial & Commercial Bank of China & China Construction Bank:

- ICBC & CCB are both Chinese state own banks, and as such you can see how similar their missions statements are. It’s almost risible. They are also completely abstract and without clear factual mission. So were they successful in achieving their mission? It’s simply irrelevant when you know how this sector works in China. Decision making is often done out of the company’s HQ, so why bother having mission you cannot control. So here again, you can very much doubt about the authenticity of all corporate, environmental and social responsibilities and actions listed on their website.

Side note, I closed my personal ICBC account years ago, and always stayed away from CCB. At professional level, ICBC is definitely better in services and products than other Chinese state alternatives (CCB, BOC, ABC…), but still behind foreign or private banks. So at least for the customer part, it is a fail.

Apple & Samsung:

- No need to present Apple and Samsung. However, their annual report and website do not list any clear vision of mission. Samsung corporate vision page is written in a very odd English and I do not speak Korean. Meanwhile, searching “mission statement” on Apple website lead to iTunes albums… I’m not sure what this means but no mission statement to report.

Where does that leave us?

So, looking at last year top companies for profits, we can very much doubt that financial success and mission achievement are linked, and it really makes us wonder if these companies have a mission for our benefit even though we do purchase their services, making them that profitable.

One oil company owned by princes, two banks owned by communists and two tech giants. This was just a random sample, but I invite you to go down the list.

No wonder Effy felt a bit useless these days…

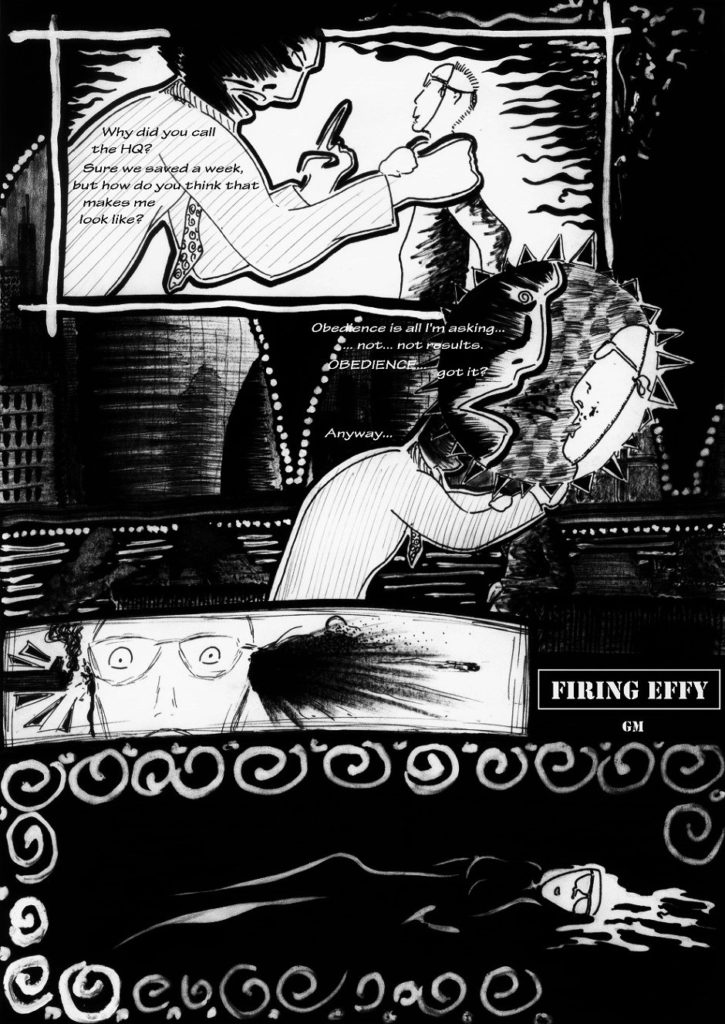

Leadership, inefficiency nd self-preservation

“Effy – The living efficiency” is based on a bold assumption: organizations and leaders value efficiency as an objective worth fighting for. “Firing Effy” questions this assumption, in light of leadership reasonable inefficiency aiming at self-preservation.

Efficiency is a fundamental and universal objective

This message is spread all over, erected as a basic irrefutable dogma. It can be seen in advertisements & corporate slogans (the less is more campaign is a blatant example), pop culture (real tv show such as the weakest link), economic & philosophical theories (notions of development and progress), and so it goes. The world is constantly telling us that efficiency is better and that organizations are helping it to get there.

A few exceptions challenging the common understanding of efficiency can be seen. However, these are exceptions that prove the rule, and they seldom make a frontal rhetorical attack on the core precept that “more efficiency is better”. Slow food (article from Slow Food) or slow fashion (article from Sloww) for example challenge the need for speed and cost efficiency, but not for efficiency overall, they only question the factors we use to assess efficiency (a topic covered in Meeting Effy & Humanitis).

Inefficiency as a leadership reality

So logic would point that organizations and their leaderships align actions with their words. So what to make of the slow energy transition? And why is there so many legal and financial hurdles built against high-potential new technologies? Crypto-currency, 5G, dna modification, facial recognition, deep-learning, and so on, just to name a few… And what about lavish spending for inconsequential meetings? Some example were outrageously polemic, because risks and morals must be taken away to stick on efficiency assessment alone. And from that efficiency standpoint, these examples are all consequences of decisions made against the pursuit of a universal efficiency.

Reality is that universal efficiency seldom is an objective; for good or bad. Decades of observations and experiences help build a pattern. That is that most decisions for or against efficiency (including my own) were taken with one concern over any other: self-preservation of leadership. And so carbon based energy organizations slow down the transition. And so countries and banks rule against crypto-currency up until they can make their own. And so divisions always make sure to use up all their budgets so that it can be renewed yearly. And it goes…

In fine, what leadership value above all (efficiency, moral or reason), is stability… their own even more so!

Firing Effy: Leadership as universal efficiency’s ultimate nemesis

This phenomenon does not limit itself to world changing decisions, these were examples to illustrate the point. On daily basis and at all level, personal interests, ego position and politics often impact leaders’ decisions far more than the universal efficiency they vouch to fight for (which was also the subject of The Reflecting Vixen and Bored Meeting). This is not a moral judgement. This is more a factual appraisal that people should not forget when dealing with leadership (as subordinate or leader).

This week’s episode displayed just that. An employee forgetting this real life fact, while his leader valued self conservation more than its group’s efficiency, thus “firing” Effy.